CAPATA Financial’s take on today’s FOMC press conference and announcement:

Notable comments from Chairman Powell during today’s FOMC press conference and announcement.

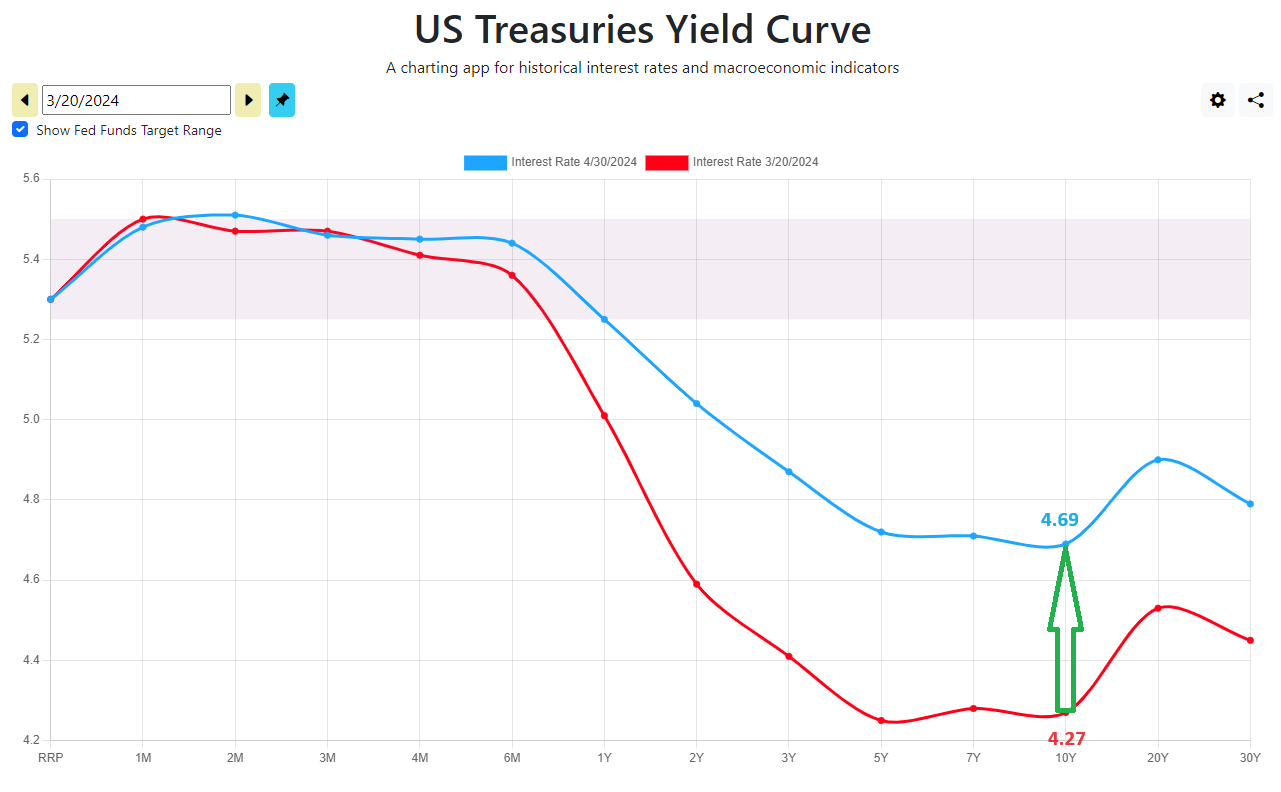

- The Treasury yield curve depicted below illustrates the yield curve movement from 03/20/24, the date of the last FOMC meeting, to 04/30/24:

- We observed another +40bps shift in the 10-year yield between today and the last meeting. Previously, we experienced a +50bps increase between meetings from the September 2023 meeting to the November 2023 meeting. Notably, the 10-year yield rallied by 100bps from the November 2023 FOMC meeting to the end of the year. This movement in the 10-year yield at the end of 2023 was significant, as it occurred without a recession; in fact, GDP increased by 3.4% in Q4 of 2023. Typically, such a rally would signal economic stress or a recession, but in this case, it was achieved through forward guidance via speeches and SEPs alone.

- The Federal Reserve has announced the tapering of balance sheet reduction, slowing Quantitative Tightening (QT): Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion. We interpret this as a dovish signal, as maintaining a larger balance sheet will provide the NY Fed Open Market Desk with greater flexibility to adjust the maturity of assets.

- Restrictive monetary policy has exerted downward pressure on economic activity and inflation. Powell stated that the next interest rate move is ‘unlikely’ to be an increase. Key points include:

- Economic growth has decelerated from 3.4% GDP growth in Q4 2023 to 1.6% GDP in Q1 2024.

- The labor market remains tight, with unemployment remaining low at 3.8%. Payroll job gains averaged 276,000 jobs per month in Q1.

- Nominal wage growth has moderated over the past year, and the jobs-to-workers gap has narrowed.

- We see a better balance between our dual mandate of price stability and maximum employment: Powell made this comment during the press conference, explaining that when inflation was peaking, unemployment was still below 4%, and it has remained so as significant progress has been made in fighting inflation. With inflation decreasing, the committee can now also consider a potential significant increase in unemployment, which would prompt rate cuts.

In summary, as the Fed maintains ‘restrictive’ rates for longer, we anticipate continued pressure on interest rate-sensitive sectors of the economy (CRE, housing, credit tightening, etc.), as well as overall growth. The only dovish signal from the Fed today was the announcement to slow QT. Slowing the balance sheet runoff will provide the Fed with additional tools, in the form of a larger balance sheet, to extend the maturity of holdings, thereby exerting downward pressure on longer-term interest rates. This, combined with Powell’s continued references to the likelihood of the next rate move being a cut, reinforces our view that long-term interest rates (excluding any volume premium shocks) are likely to remain below their mid-October 2023 peak. As wage pressures and borrowing costs increase, we remain vigilant for stresses in the municipal and overall bond markets, particularly concerning credit spreads. In short, many unknown risks persist the longer the Fed remains on hold.

| mike@capatafinancial.com |

| 9493045300 |

| CAPATA Financial, LLC Partner |

| http://www.capatafinancial.com |

1 The Fed’s dot plot is a chart updated quarterly that records each Fed official’s projection for the central bank’s key short-term interest rate, the federal funds rate. The dots reflect what each FOMC member thinks will be the appropriate midpoint of the fed funds rate at the end of each calendar year.

Source: Federal Open Market Committee (FOMC), Press Conference, May 1st, 2024

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

CAPATA Financial LLC offers wealth management services through various unaffiliated companies including advisory services offered by Diversify Advisory Services (“Diversify”) an SEC registered investment adviser. CAPATA Financial LLC offers additional investment services and securities through DFPG Investments, LLC., a broker/dealer, member FINRA / SIPC, and an affiliate of Diversify.