CAPATA Financial’s take on today’s FOMC press conference and announcement:

Notable comments from Chairman Powell during today’s FOMC press conference and announcement.

From the FOMC statement:

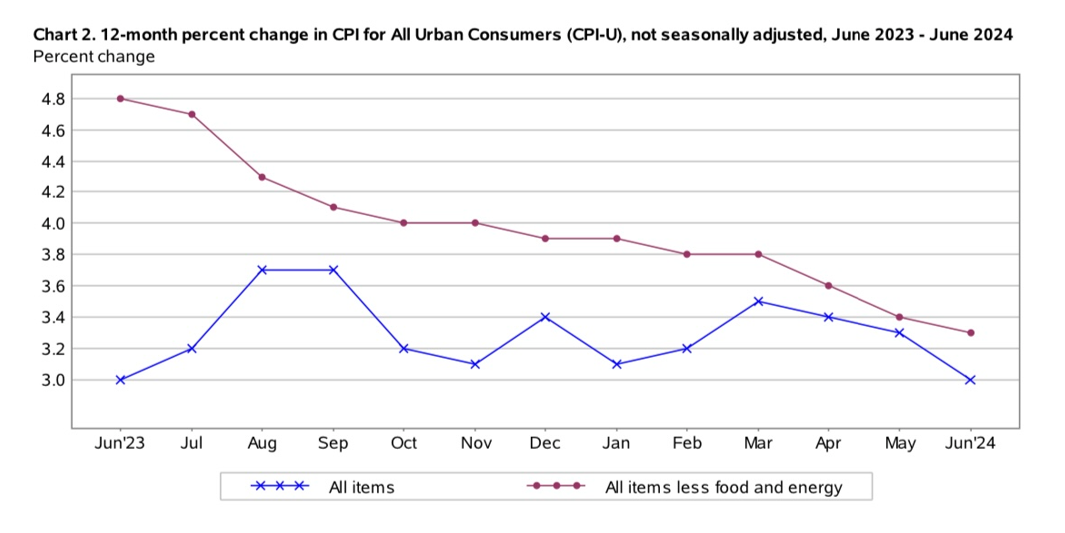

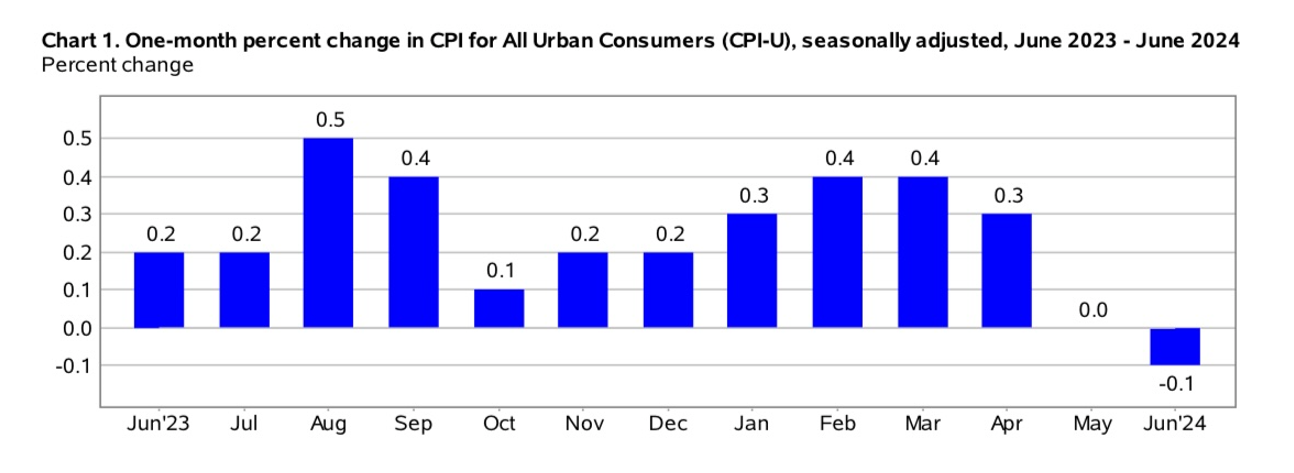

- –“In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective.” : Recall, Powell has stated that the word ‘satisfied’ and the number 3 cannot be in the same sentence. This comes as the most recent CPI print came in at 3%.

Source: U.S. Bureau of Labor Statistics July 11, 2024.

- “Inflation has eased over the past year but remains somewhat elevated.”: The term ‘somewhat’ is the relevant point in this statement. We wouldn’t exactly call this Powell “banging the pot” in terms of Fed speak and preparing the markets for a future rate cut, but it is language moving in that direction.

Source: U.S. Bureau of Labor Statistics July 11, 2024.

From the FOMC press conference:

- -“Broad sense of the Committee…Economy moving closer to the point at which it will be appropriate to reduce our policy rate.”: Powell made this statement during his press conference in response to a reporter’s question about a possible September rate cut. Again, this is one of many subtle hints throughout the press conference that a rate cut is imminent barring any unanticipated inflation shock.

- “2nd quarter inflation data added to our confidence”: Powell acknowledged that first quarter inflation data was not good and that second quarter data had been positive. He reiterated that the balance of risk to their dual mandate of maximum employment and price stability continues to come into better balance. The Committee is acutely aware of the risk of holding policy too tight for too long and the risk of loosening policy too much or too quickly and seeing a resurgence in inflation.

- “Policy is well positioned to deal with risks and uncertainty that we face in pursuing both sides of our dual mandate.”: Powell reiterated throughout the press conference, in response to reporters’ questions, that policy was in a good place to respond to risks on either side of their dual mandate. With policy staying on hold for over a year now (the last increase was in July 2023), many economists have estimated that the neutral rate of interest (R*: R-Star) is much higher than it was prior to the pandemic. This, in theory, gives monetary policy more flexibility and a greater impact on broader economic conditions without resorting to non-traditional (i.e., QE) policy tools. With the June headline PCE (Personal Consumption Expenditures – the Fed’s preferred inflation gauge) reading at 2.5%, while short-term interest rates remain above 5%, real rates are significantly positive on the short end of the curve. Powell further stated that “the time is coming to reduce that policy.”

- “Would not like to see material cooling in the labor market.”: Powell talked about how the Committee can now more broadly focus on the employment side of their mandate, having brought inflation closer to their target range. With inflation well above target and unemployment in the mid-3% range, the Committee focused all of its policy attention and tools on bringing inflation closer to the target. Now that this has happened, the Committee can also adjust its policy to accommodate any potential departures from its employment mandate.

In summary, Powell was much more dovish in his press conference than would be interpreted from the language of the FOMC statement today. He reiterated that the stance of monetary policy was restrictive and that it was well-positioned to react to either side of their dual mandate moving out of balance from their congressionally mandated goals of two percent inflation and maximum employment. With the Committee continuing to see good inflation readings and now starting to worry about further loosening in labor markets, they have all but assured the financial markets of a cut in September.

The question now becomes not whether short-term rates will move lower in the near future, but with the CBO estimating an approximate $1.9 trillion deficit in 2024, will broad credit conditions, as determined by the 10-year Treasury note, follow short-term yields lower, or will the long end of the curve remain higher as the market attempts to price in a ‘volume premium’ on the issuance of Treasuries to support fiscal deficits and overall debt levels?

| mike@capatafinancial.com |

| 9493045300 |

| CAPATA Financial, LLC Partner |

| http://www.capatafinancial.com |

Source: U.S. Bureau of Labor Statistics July 11, 2024

Source: Federal Open Market Committee (FOMC), Press Conference, July 31, 2024

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

CAPATA Financial LLC offers wealth management services through various unaffiliated companies including advisory services offered by Diversify Advisory Services (“Diversify”) an SEC registered investment adviser. CAPATA Financial LLC offers additional investment services and securities through DFPG Investments, LLC., a broker/dealer, member FINRA / SIPC, and an affiliate of Diversify.