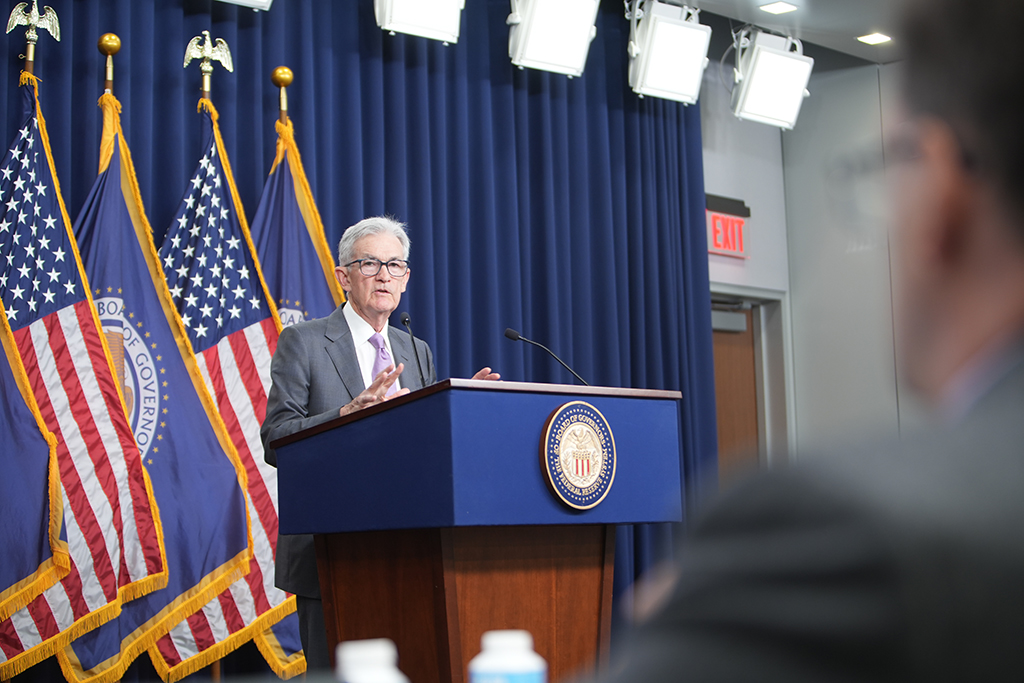

Fed Talk

Fed Talk 1.28.26

Fed Talk

Fed Talk 12.10.25

Fed Talk

Fed Talk 10.29.25

Fed Talk

Fed Talk 9.17.25

Fed Talk

Fed Talk 7.30.25

Fed Talk

Fed Talk 6.18.25

Fed Talk

Fed Talk 5.7.25

Fed Talk

Fed Talk 3.19.25

Fed Talk

Fed Talk 1.29.25

Fed Talk

Fed Talk 12.18.24

Fed Talk

MARKET uPDATE

All Muni Bonds Are Not Created Equal

Mikes Corner

Retirement / Planning

Exploring retirement options

Retirement/Planning